IRS W-9 Form for 2023 in PDF

New Updates

Federal Tax Form W-9 for 2023 in PDF

Get FormThe Ultimate IRS W-9 Form Guide for Tax Compliance in 2023

IRS Form W-9 serves a significant role in the U.S. taxation system. Essentially, it is a request for Taxpayer Identification Number and Certification used by individuals and entities to provide identifying information to entities that will pay them income during the tax year. Employers use the provided information on the IRS 2023 W9 form to prepare other important tax documents. Hence, it is essential to ensure its accuracy and timeliness.

In this context, form-w9-2023.us becomes an invaluable resource. Offering the most recent IRS W9 form for 2023 (PDF), the site ensures you stay updated with the latest guidelines and standards. Moreover, our website complements the technical document with comprehensive instructions and well-explained examples. These materials significantly simplify the process of filling out the form. You will find the IRS W-9 form for 2023 with instructions in an easy-to-understand manner, making the obligation of tax reporting less overwhelming and more achievable for everyone. Thus, form-w9-2023.us becomes an essential toolset for accurate and efficient tax reporting.

IRS Form W-9 Functions & Features

The W-9 form is a crucial document for tax procedures in the United States. An individual, typically a freelancer or independent contractor, must file this form. Its purpose is to provide an employer with accurate taxpayer identification information so that the employer can properly report payments made during a tax year.

A professional graphic designer, Bruce Thompson, exemplifies one such person who must file the W-9 form. In 2023, Bruce embarks on project-based collaborations with various companies. As he isn't a full-time employee of any of these organizations, they will each need a blank W9 form in 2023 duly filled out by Bruce. This will permit these companies to issue a 1099-MISC form that reports payments made to Bruce, ensuring accurate earnings declaration and compliance with the tax norms.

A professional graphic designer, Bruce Thompson, exemplifies one such person who must file the W-9 form. In 2023, Bruce embarks on project-based collaborations with various companies. As he isn't a full-time employee of any of these organizations, they will each need a blank W9 form in 2023 duly filled out by Bruce. This will permit these companies to issue a 1099-MISC form that reports payments made to Bruce, ensuring accurate earnings declaration and compliance with the tax norms.

In Bruce's case, the IRS printable W-9 form in 2023 takes on a vital role. Bruce provides his correct name, address, and Social Security Number to every company he associates with through this form. Without this, the organizations he contracts with might face difficulty accurately reporting his compensation.

As demonstrated by Bruce's situation, the IRS W-9 tax form in 2023 is a non-negotiable entity. Both Bruce, as an independent contractor, and his clients, as payers, must understand their responsibilities pertinent to this form to steer clear of potential tax-related discrepancies.

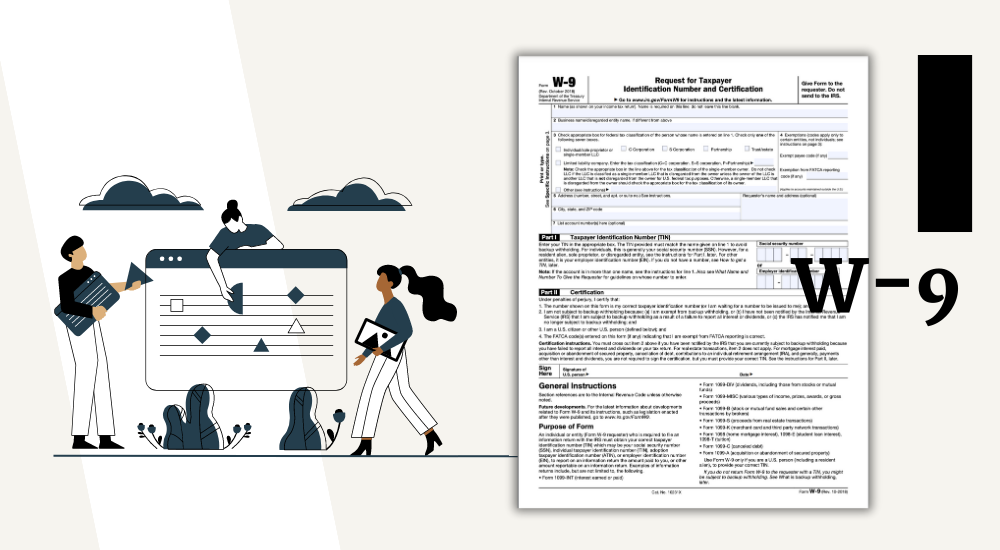

Blank W9 Form for 2023: Structure & Requested Information

The structure of the W-9 template is designed to be straightforward to complete. Remember that we offer the W9 form 2023 in PDF for download, so you don't need to look for it elsewhere.

The first request asks for your legal name to be written exactly as shown on your income tax return. Following this, if applicable, is the section to fill in your business or 'disregarded' entity name.

The first request asks for your legal name to be written exactly as shown on your income tax return. Following this, if applicable, is the section to fill in your business or 'disregarded' entity name.- On line 3, you must select your federal tax classification by checking the appropriate box. Please remember that taking the time to fill out a printable W9 tax form for 2023 meticulously decreases the chances of erroneous submission and potential audit.

- For line 4, enter any exemptions if they apply to you. Following this, on lines 5 and 6, you must enter your address – street and city, state, and ZIP code, respectively.

Printable W-9 Form Benefits

Given the convenience offered by the online platform, the printable W-9 2023 form can be downloaded and printed for your convenience. It's a critical document for both businesses and independent contractors. The W-9 sample also makes it easier if you need access to it quickly or want to print another for filing purposes. It's worth noting that the final information to provide is your taxpayer identification number (TIN) in Part I and then to sign and date the copy in Part II to certify the information.

Timelines to Fill Out the W-9 Tax Form in 2023

Under IRS regulations, you are not obligated to submit a specific due date for the W-9 tax form. This document is primarily requested by an entity that pays you income. Once requested, completing and returning the W-9 request promptly is generally prudent. This approach prevents potential interruptions with your income flow.

Not adhering to the guidelines regarding using the IRS W9 form for 2023 printable can lead to complications. For instance, if the IRS detects that you've provided incorrect information on your W-9 sample, you may face a penalty. This consequence underscores the importance of providing accurate data.

Moreover, failing to submit the printable or IRS W-9 fillable form in 2023 on time does not directly incur a penalty. However, it could result in backup withholding, causing you to lose some of your income to the IRS. To avoid these complications, ensure your tax records are precise and timely.

Federal Tax Form W-9 for 2023 in PDF

Get FormIRS W-9 Tax Form: Answering Your Questions

-

Where can I access the W9 form for 2023 printable for free?

You can find the relevant PDF with a blank W-9 copy right on our website. This online availability ensures ease and convenience. It's essential always to ensure the template is the most recent version to avoid any complications.

-

Can I fill out the W9 form for 2023 for free online?

Yes, the W-9 template is available as a fillable PDF, allowing you to fill it out directly on our website. You don't need any special software to complete it, making the process free. Remember to save and print a copy of the completed request for your records.

-

Can I request a free printable W-9 form for 2023 from the employee?

Yes, you can do that. The IRS doesn't update the template annually. It's important that the employee double-check and send you the most recent W9 version to ensure accurate information. But we advise to download the W-9 form for 2023 online to avoid waiting.

-

How long does it take to fill out the IRS W-9 form for 2023 fillable on the computer?

It could take 5 minutes to an hour, depending on whether you have all the information readily available. This template is straightforward and includes basic personal and tax information.

-

Can I use a free fillable W9 form for 2023 from the last year?

Yes, you can use it from last year as long as there are no significant changes in the document by the IRS. However, checking our website for the most current revision is always safer to ensure all information is up-to-date and accurate.

Form W-9 for Real Estate Transactions

Form W-9 for Real Estate Transactions